Institutions

For institutions, Auria offers a truly modular and configurable platform that grows with your enterprise. Deploy only the components you need today—then seamlessly activate additional modules as your operations expand. With granular permissioning, custom dashboards, and architecture built for scale, you maintain control while gaining flexibility. As your organization evolves, Auria scales effortlessly.

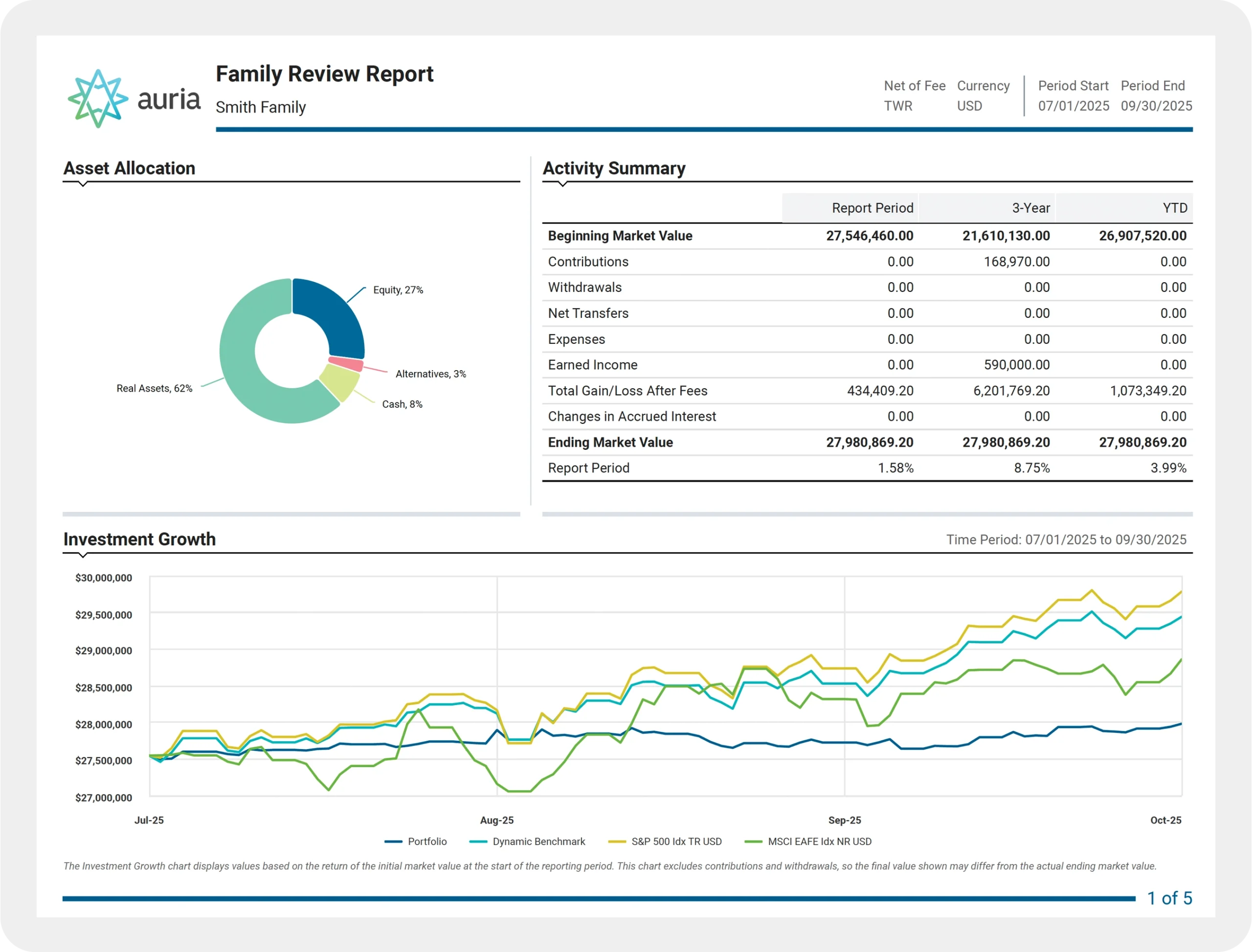

Consolidated reporting and billing

A single, trusted picture of the total fund.

Unified, always current: One portfolio across custodians and vehicles (LPs, SMAs, commingled funds) with live positions, performance, allocations, and policy-level benchmark comparisons down to the holding.

Actionable & reportable: Highlight concentration, liquidity buckets, capital calls, and spending-policy needs—then export, share, or leverage the same data for board, investment, and audit workflows.

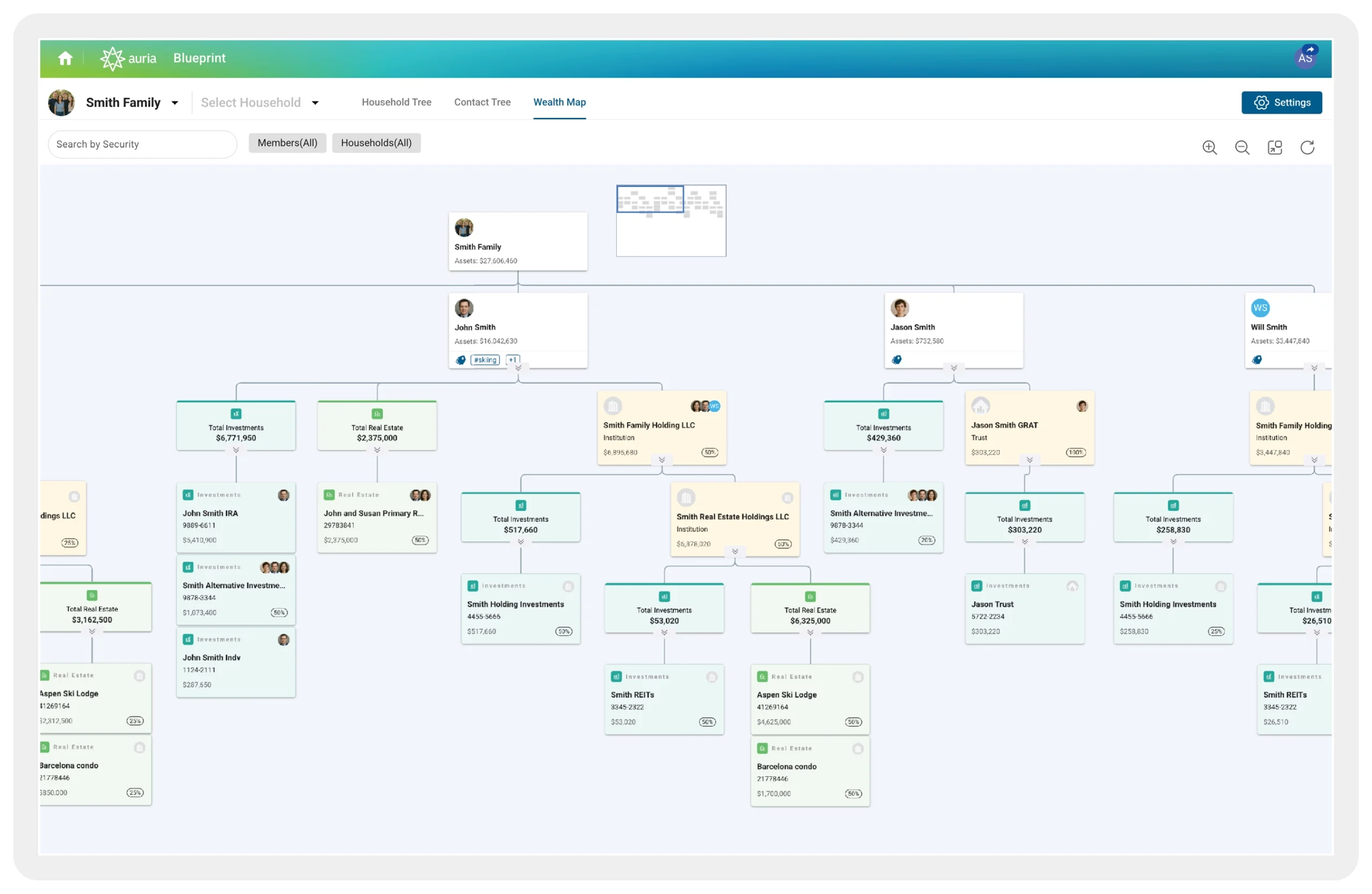

Entity management

A clear, navigable map of legal entities, pools, and investment vehicles.

Clarity at-a-glance: Blueprint renders entities, funds/pools, and investment vehicles in one interactive view—with ownership %, commitments, and capital-flow paths.

Depth when needed: Navigate nested SPVs and fund-of-funds; filter by restriction, purpose or department; drill from total organization to pool, vehicle/manager, and holding.

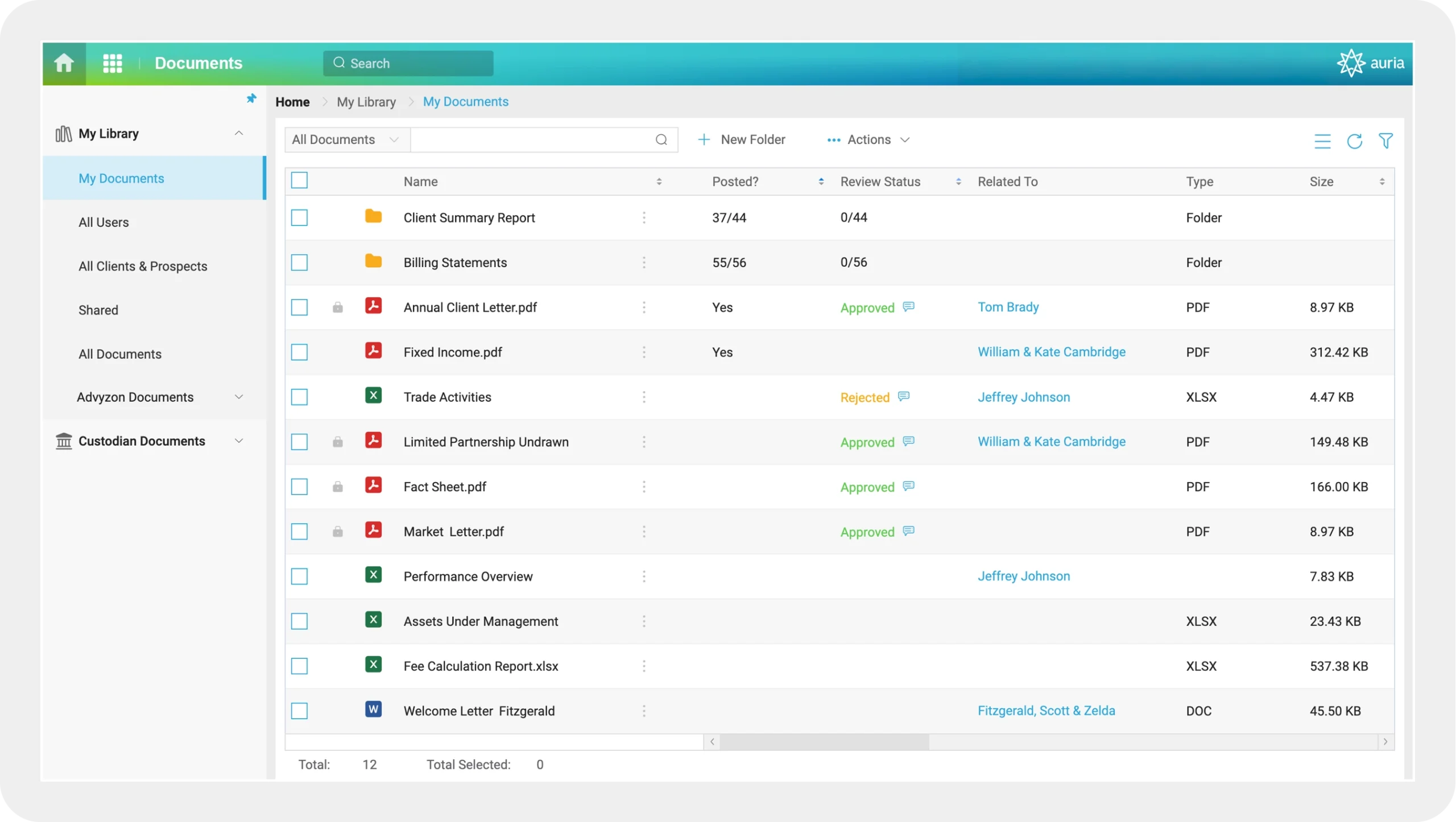

Document management

A secure, searchable system built for institutional oversight.

Secure, centralized record: Store and index key institutional documents with version control and retention policies; grant role-based access to staff, committees, auditors, and advisors.

Contextual & audit-ready: Link files to entities, funds/pools, vehicles, and transactions; export packets with full audit trails for board reviews and audits.

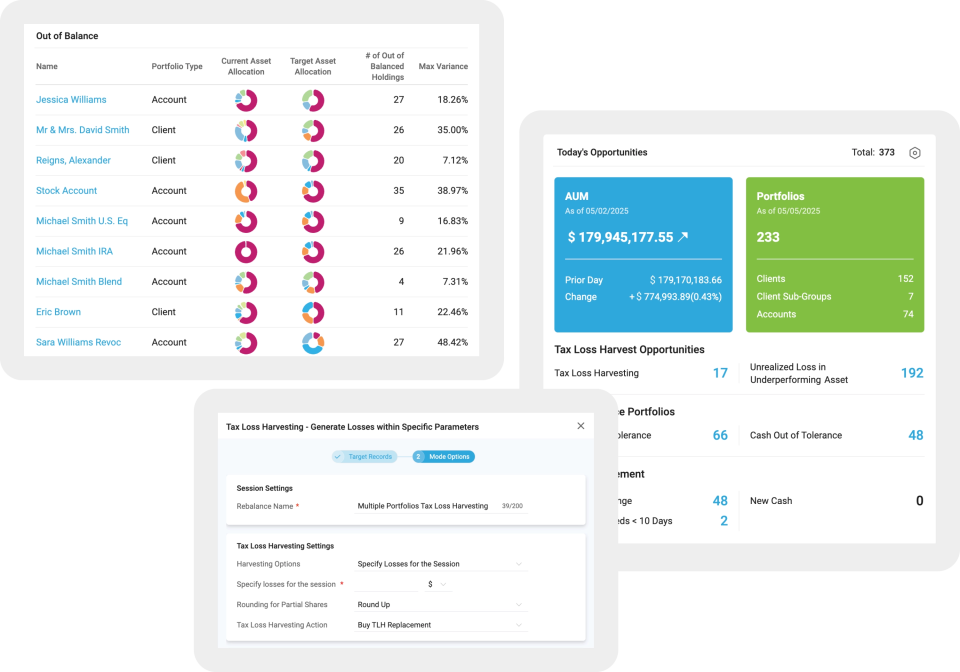

Trading and rebalancing

Policy-aligned models, fast workflows, and multi-custodial execution.

Models to execution: Create policy, asset-class, and Model-of-Models structures; rebalance with eight strategy options; push block, allocation, and FIX orders across custodians—fully auditible.

Cash & controls: Apply tolerance bands and minimums at org/pool/account levels to fund spending policy, meet capital calls, and maintain IPS-aligned liquidity.

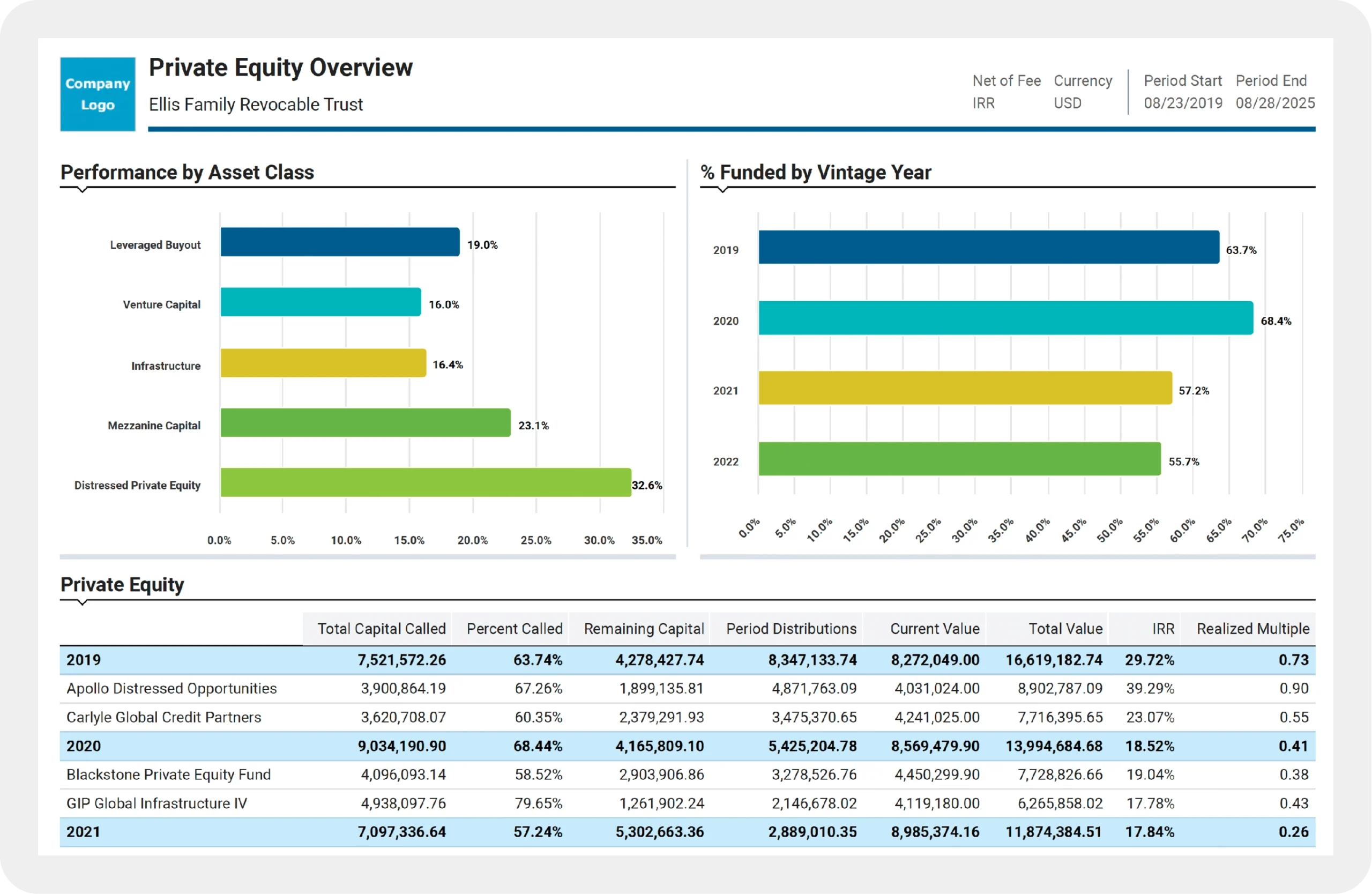

Alternatives management

Managed alts data—without the operational burden.

Managed from end to end: Onboarding, historical backfill, reconciliation, and ongoing maintenance handled for you—so complex alts stay current without internal lift.

Integrated & reliable: Timely, accurate alts data flows into the Auria platform, freeing the family office to focus on decisions—not operations.

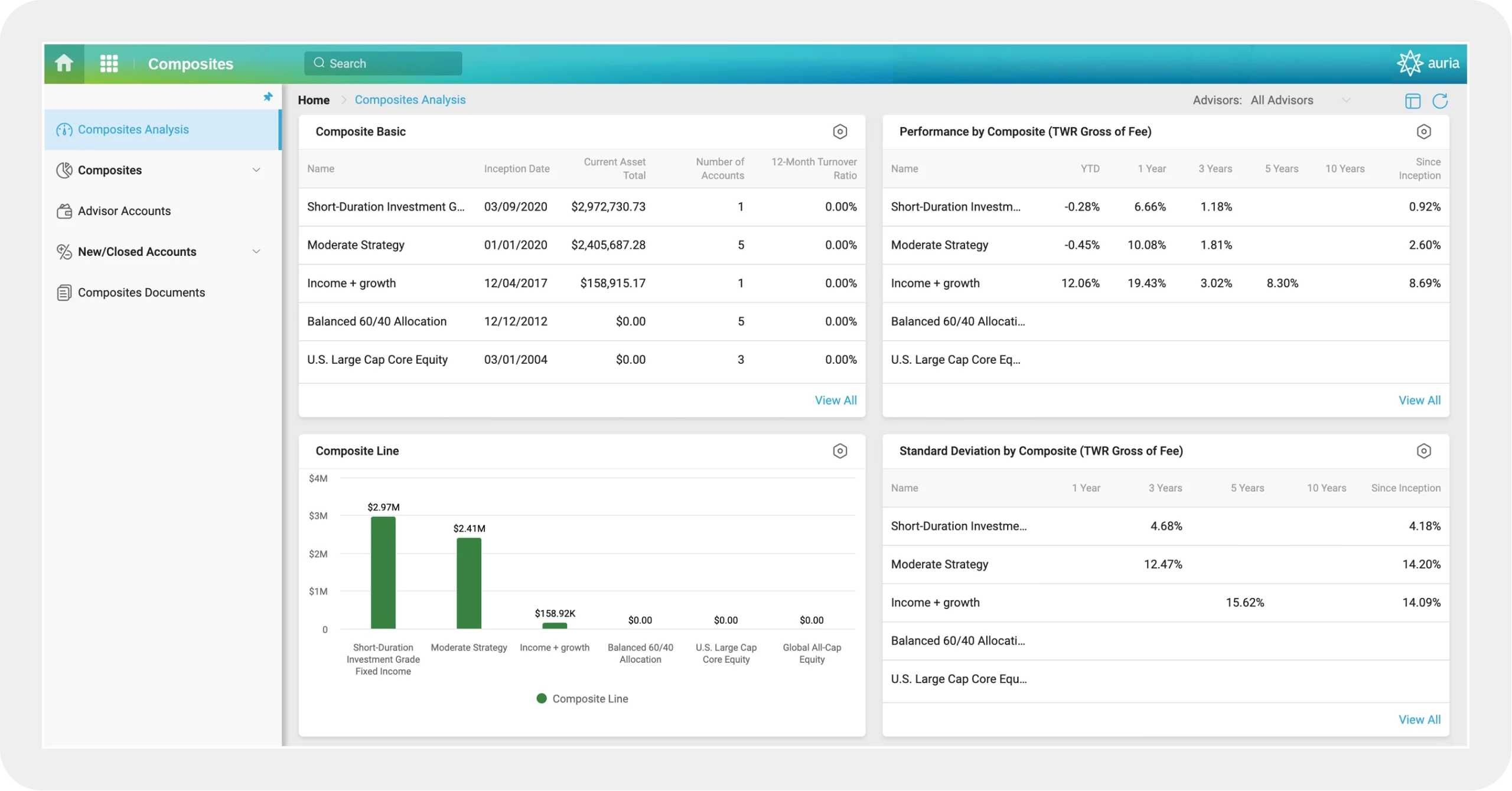

Institutional performance & composites

Institutional-grade performance with multi-period contribution, policy blends, and verification-ready composites.

Measurement you can defend: TWR/IRR with multi-period contribution by segment, alongside policy and custom benchmarks.

Policy & governance: Rule-based composites with change logs, standard disclosures, and verification-ready exports for boards and auditors.

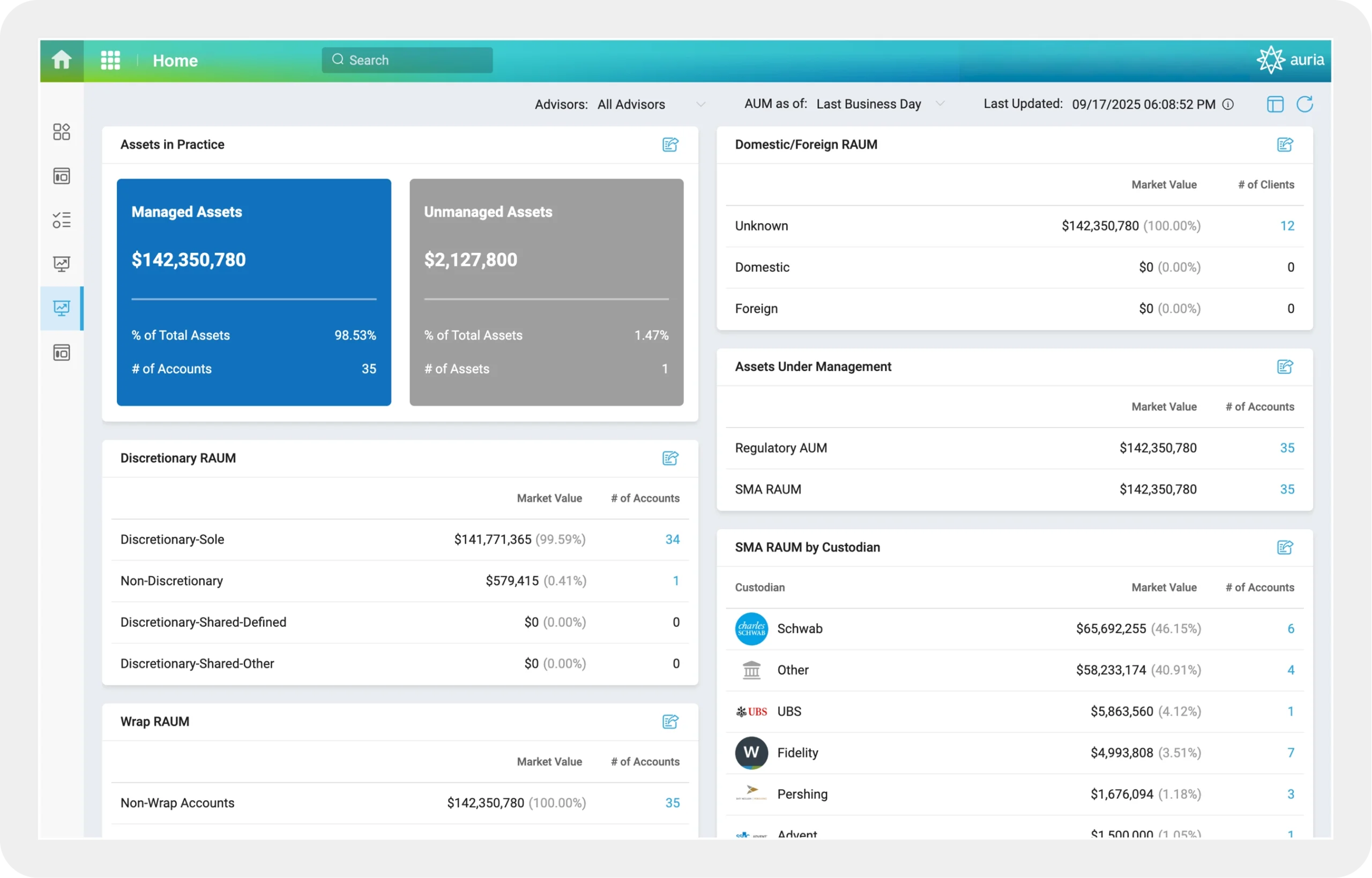

Firm-level management & insights

Monitor KPIs: Auria provides home office teams with a powerful command center to oversee and manage their entire organization—from global branches to regional offices and individual advisors. With firm-level visibility, leadership can monitor key metrics, track performance, and maintain consistency.

Stay informed: Centralized oversight allows for deeper insights into assets, client relationships, and operational efficiency at every tier of the enterprise. Whether identifying trends across regions, reviewing advisor activity, or ensuring compliance with firm policies, Auria makes it simple to stay informed and agile. The result: a more connected, data-driven institution that operates seamlessly across offices, teams, and generations of clients.

Learn more

Book a personalized demo to explore how we can help grow your business and deepen client trust.