RIAs and wealth managers

Wealth managers serving ultra-high-net-worth (UHNW) families need institutional-grade tools without sacrificing agility. Auria empowers RIAs to deliver the sophistication UHNW clients expect—comprehensive entity mapping, consolidated reporting, and alts oversight—within a unified, configurable platform.

Built on a modular architecture, Auria scales effortlessly alongside your practice, integrating seamlessly with existing workflows. Whether UHNW households make up 5% or 50% of your book, Auria gives you the power, precision, and polish to serve them like a family office—without disrupting your broader business.

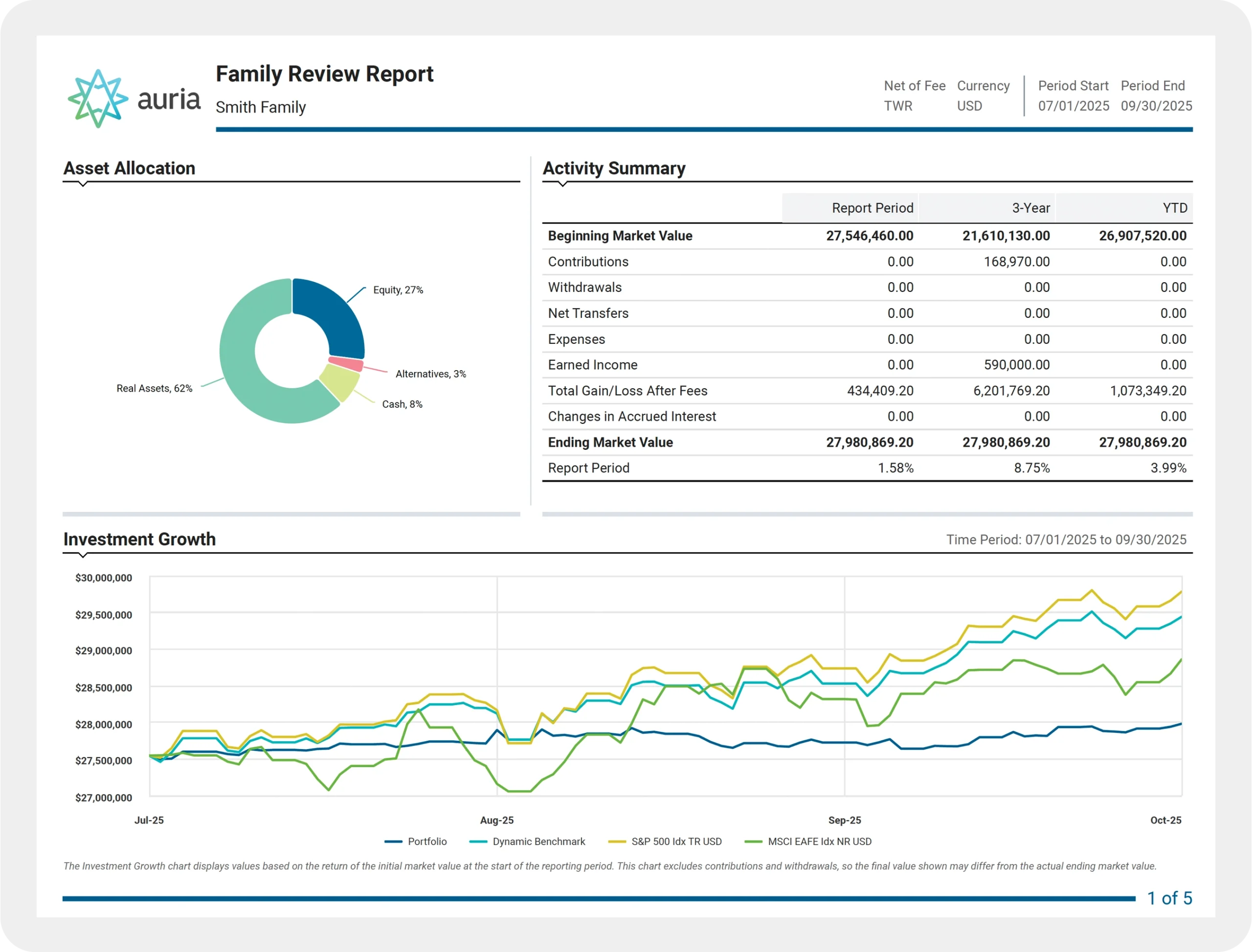

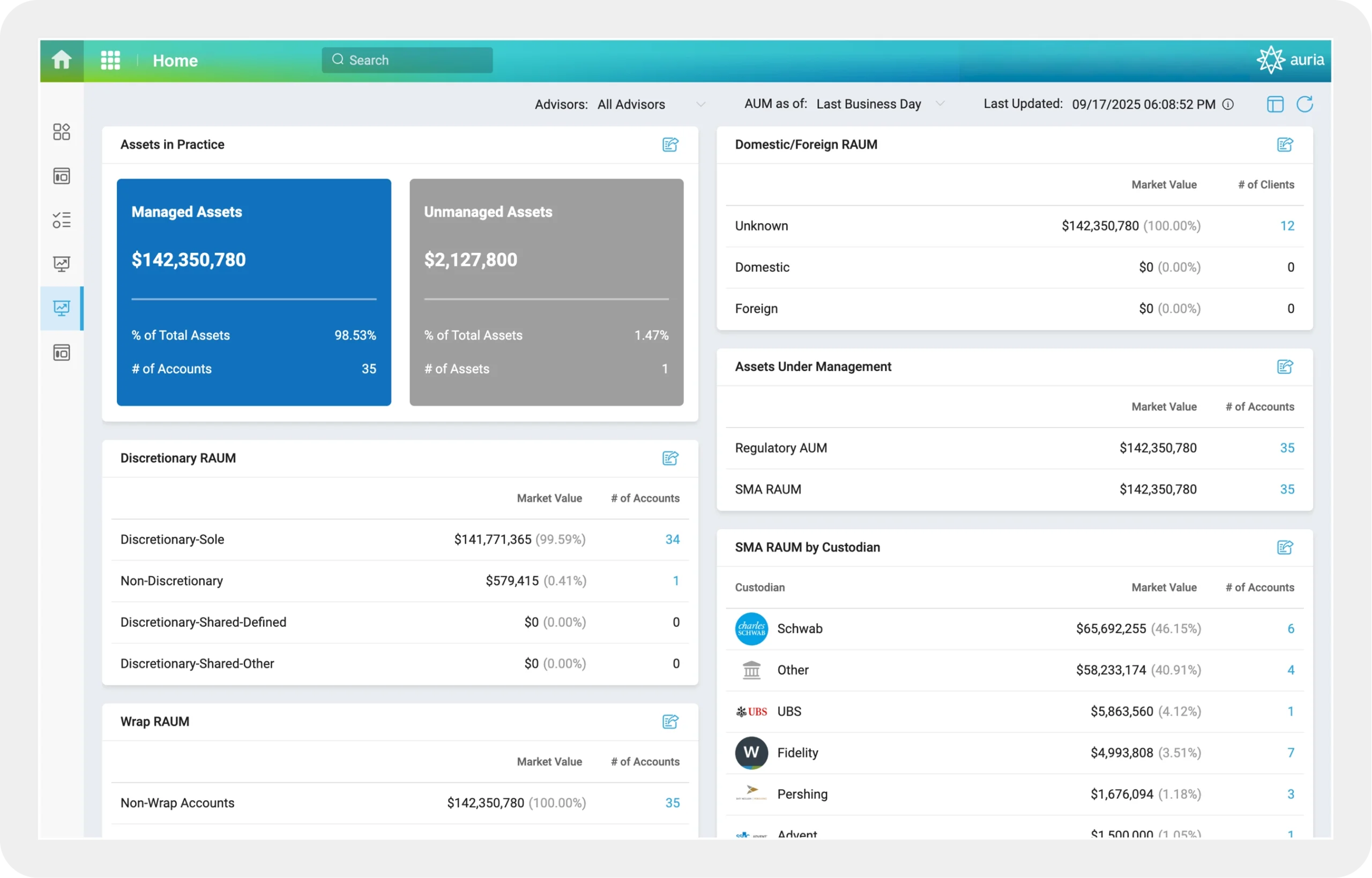

Consolidated reporting

Give advisors a single, trusted picture of each client’s wealth picture.

Unified, always current: Aggregate accounts, entities, and assets into one portfolio, with positions, performance, and allocations updating continuously and benchmark comparisons down to the holding level.

Actionable and reportable: Surface concentration, cash needs, and rebalancing opportunities across custodians, then export, share, or leverage the same data across your workflow.

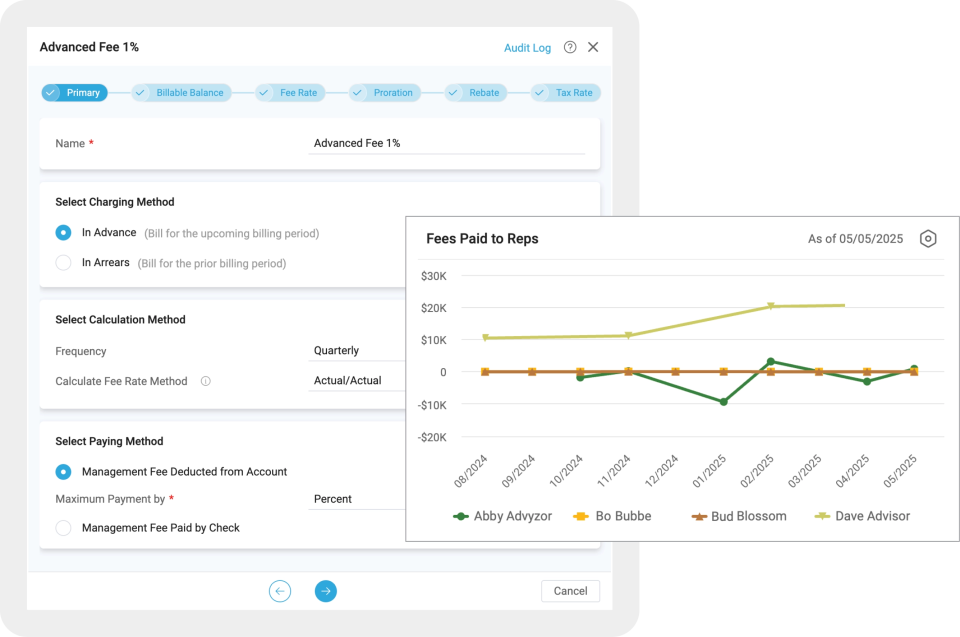

Billing and fees

Make billing a seamless extension of your advisory operations.

Flexible by design: Create fee structures that match your model—percentage of AUM, flat, tiered, hybrid, or based on average daily balances.

Automated end-to-end: From invoicing to custodian uploads, run billing cycles that typically finish in hours, giving you back time and visibility into cash flow.

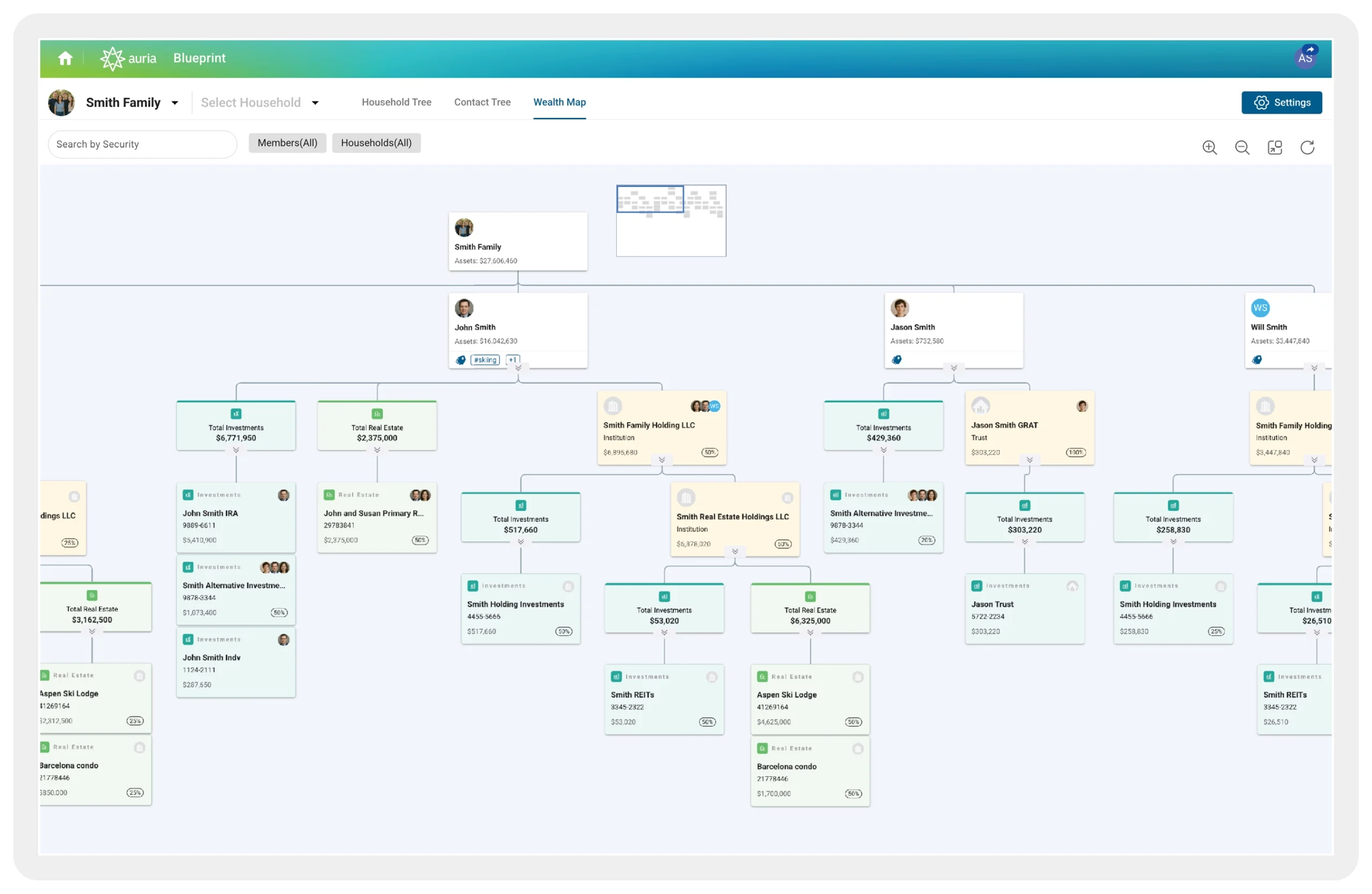

Entity management

Turn complex ownership into a clear, navigable picture with Blueprint.

Clarity at a glance: Blueprint renders family trees, entities, and assets in one interactive view—with instant ownership percentages and flow paths.

Depth when you need it: Navigate nested entities and multi-household structures with search, filters, and drill-downs to manage with precision.

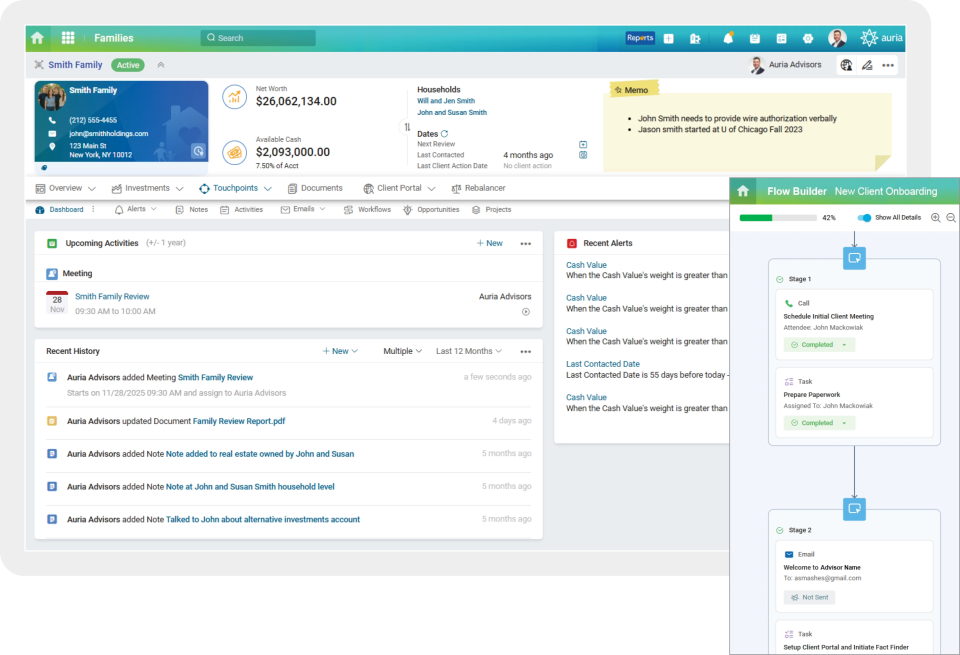

CRM

Unify relationships, activity, and portfolio data in one place.

Unified client view: Tie notes, tasks, emails, and meetings to real portfolio and performance data for a more informed, personalized experience.

Workflows & automations: Alerts and triggers drive onboarding, reviews, and follow-ups—so nothing slips, and processes stay consistent and compliant.

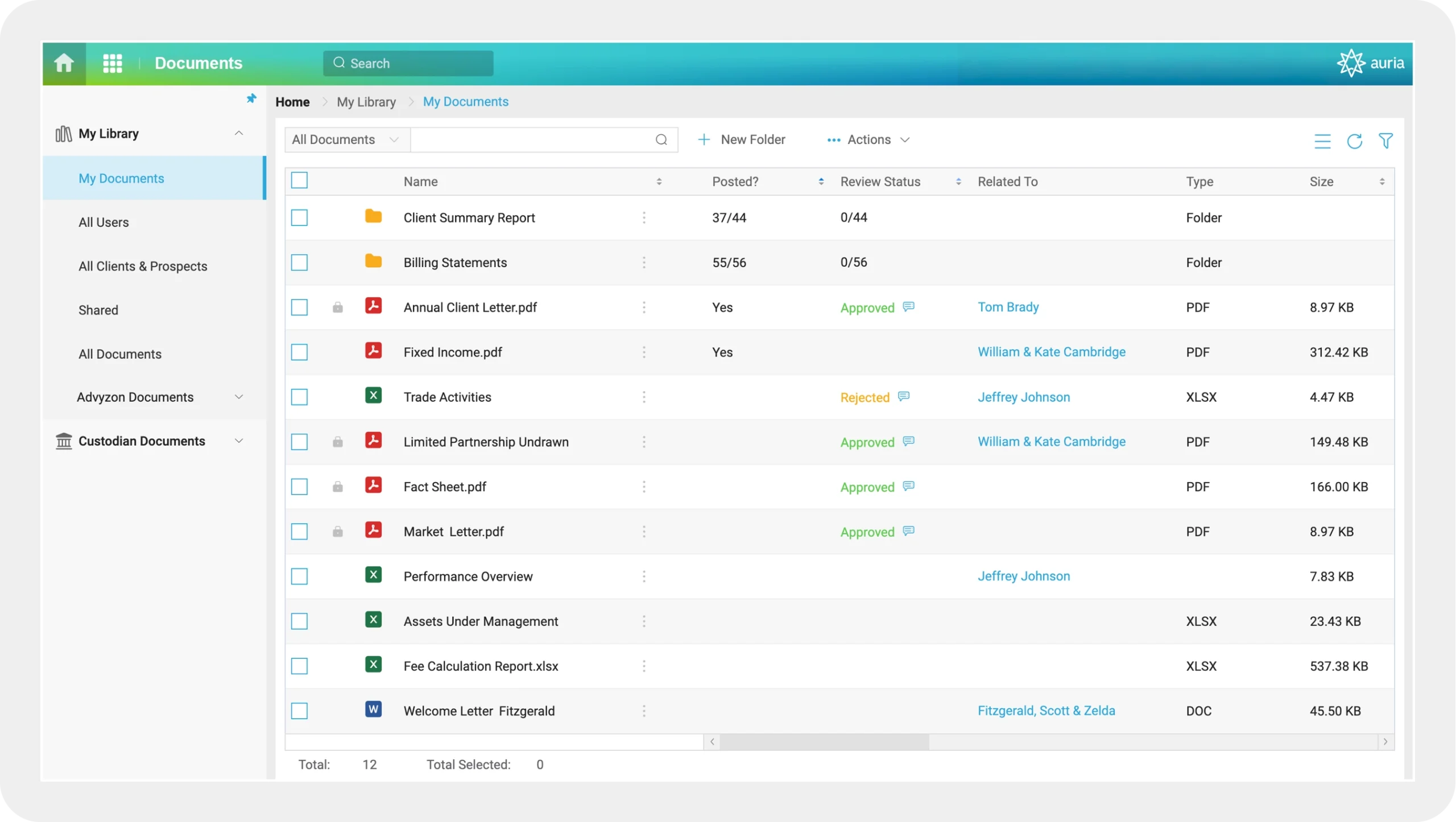

Document management

Turn paperwork into a secure, searchable digital vault.

Secure, centralized vault: Store, index, and search critical documents with version control and role-based access—so the right people have what they need, when they need it.

Built for complex families: Unify the financial record to simplify due diligence and make collaboration with advisors and families seamless.

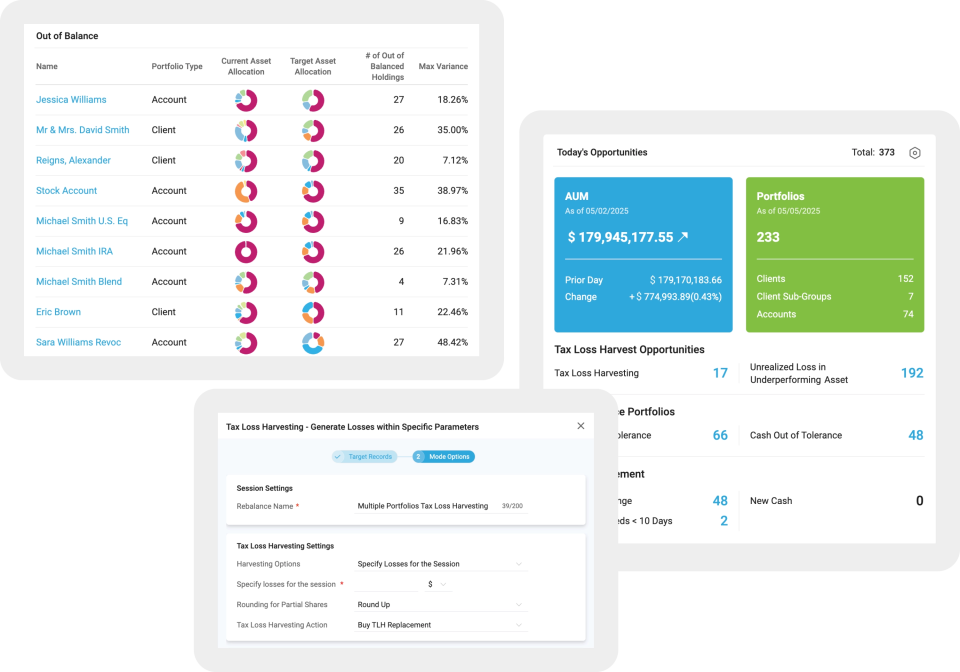

Trading and rebalancing

Powerful models, fast workflows, and multi-custodial execution.

Models to execution: Create security, allocation, and Model-of-Models structures, then rebalance with eight strategy options and push orders via block, allocation, and FIX workflows across custodians.

Cash under control: Apply tolerance bands and minimums at firm, client, and account levels to keep cash targets on track.

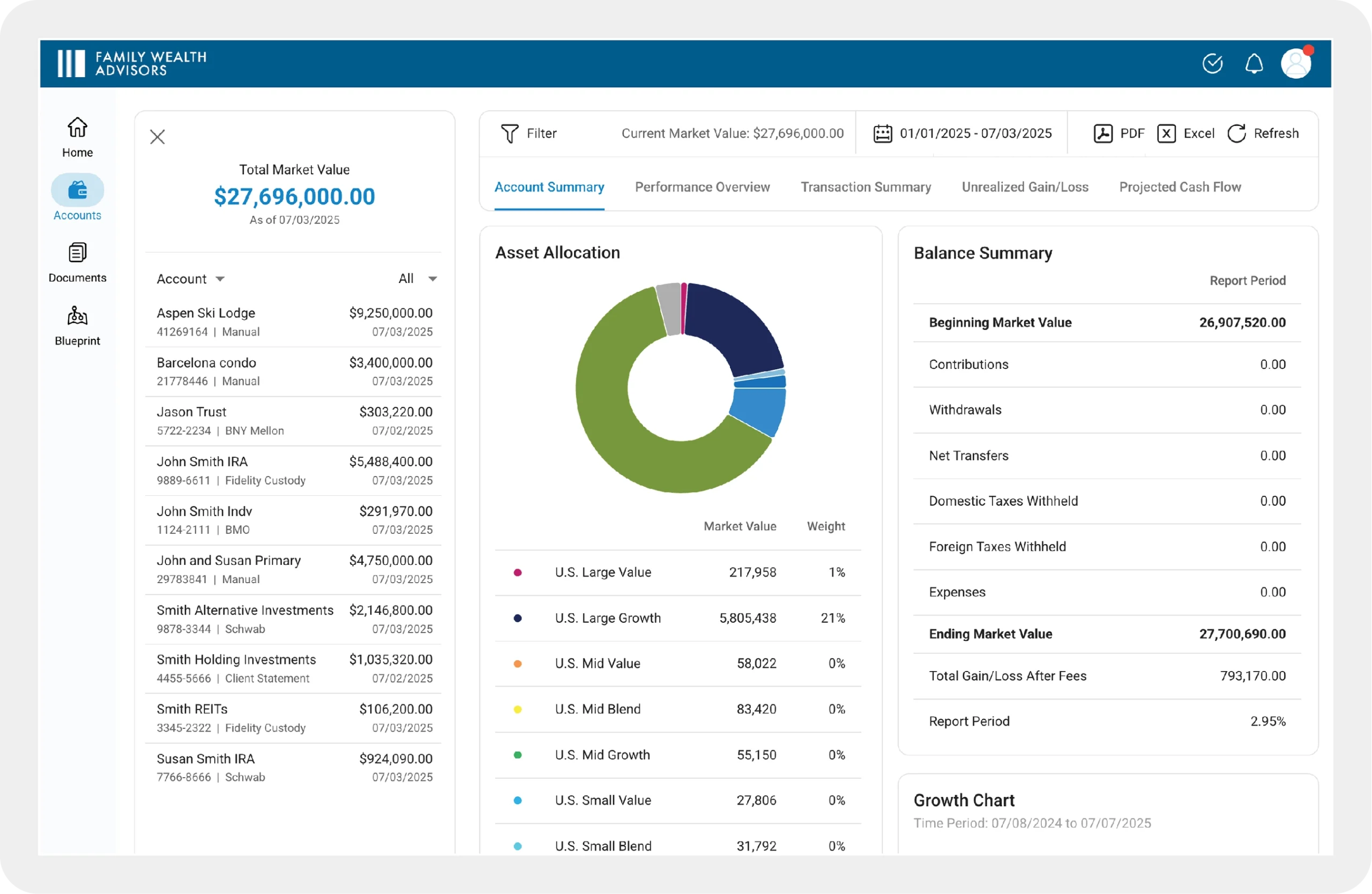

Client portal

A personalized, digital experience that delivers your brand.

Branded and interactive: Personalized access and an intuitive, configurable portal that fits your firm and keeps clients.

Reporting and collaboration: Share customizable reports (performance, transactions, unrealized gains/losses, projected cash flow) and send action items with attachments, comments, and task tracking.

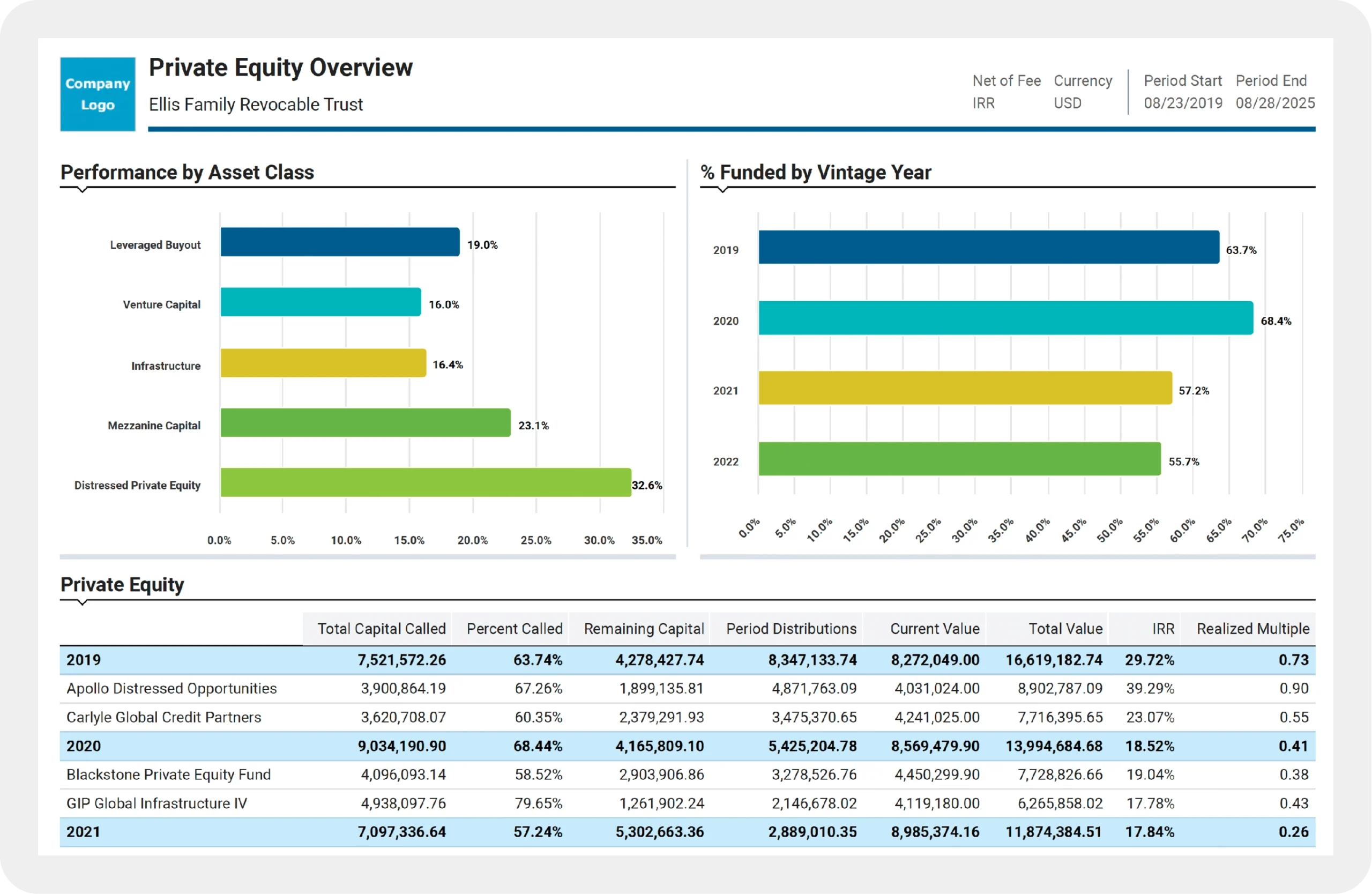

Alternatives management

Managed alts data—without the operational burden.

Managed from end to end: Onboarding, historical backfill, reconciliation, and ongoing maintenance handled for you.

Integrated & reliable: Timely, accurate alts data flows into Auria so your team can focus on clients—not operations.

Compliance

Visibility, control, and audit readiness—built in.

Audit-ready oversight: A filterable dashboard with one-click Excel exports streamlines audits and filings, while audit trails track who changed what and when.

Policies to practice: The compliance app sets retention rules and allows review workflows; document management and permissions enforcement keep everything consistent across the firm.

Learn more

Book a personalized demo to explore how we can help grow your business and deepen client trust.